Analog Devices, Inc. (ADI) announced the successful closing of the first green bond offering in the semiconductor industry. The company’s green bond issuance consisted of $400 million aggregate principal amount of 2.950% senior unsecured notes due April 2025.

“At ADI, we are committed to engineering a sustainable future and this is an important next step in driving sustainable growth for all ADI stakeholders. We are proud to lead the semiconductor industry with our green bond issuance,” said Vincent Roche, President and CEO of Analog Devices.

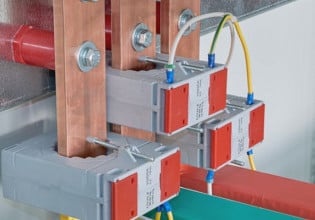

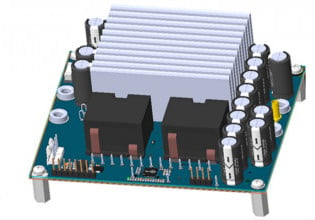

ADI intends to use the net proceeds from the offering to finance or refinance eligible projects that offer sustainability benefits, furthering the company’s commitment to environmental sustainability. The eligible categories for the use of the net proceeds – renewable energy, energy efficiency, green buildings, sustainable water and wastewater management, pollution prevention and control, clean transportation, and eco-efficient and/or circular economy adapted products, production technologies and processes – are designed to protect and regenerate the environment and are in alignment with the United Nations Sustainable Development Goals.

“We were very pleased with the significant institutional investor interest for our green bond offering. This issuance further strengthens ADI’s financial position and diversifies our debt investor base,” said Prashanth Mahendra-Rajah, CFO of Analog Devices.

In connection with the green bond, ADI worked with Sustainalytics, a leading global provider of environmental, social and corporate governance research and ratings. Sustainalytics reviewed ADI’s green bond framework and opined that it is credible and aligns with the four core components of the Green Bond Principals 2018.